What Are Your Reasons for Raising Money?

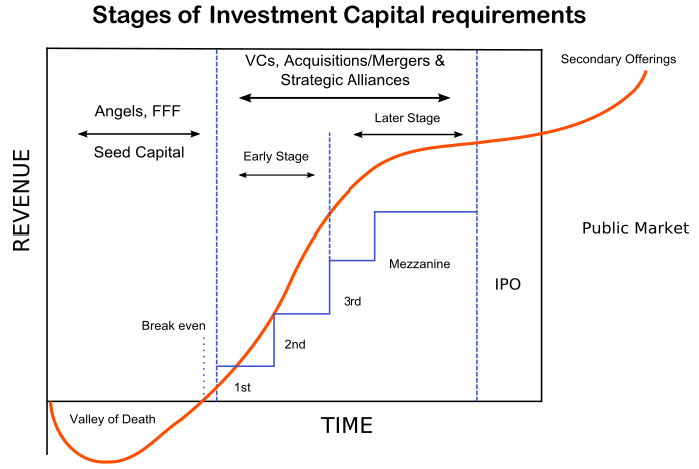

The ideal timing of a capital injection depends on each individual business and owner. There are no mapped out timelines where if (A) occurs—say, the company reaches $1,000,000 in annual revenue—then (B) follows. Economically speaking, there are general revenue-to-time investment ratios. For instance, this chart demonstrates a standardized overview of when companies typically take on funding:

Knowing when you should seek investment requires introspection and a thorough review of your business’ financial health. Often, investors take on significant risk in exchange for potential gains. In order to convince them to provide funding, you must demonstrate the company’s fundamental financial integrity and growth plan, then convince them that the exposure is worth the reward. To that end, it is paramount that you have a detailed answer for each question below: What are the reasons you need money? – This is the fundamental question. You should have a clear understanding of why you would willingly give up equity in exchange for external investment. For instance:

- Is it to create lift?

- Do you want to bring on strategic investors who will help grow the business?

- Would it be possible to keep functioning without investment?

What will you do with the money? – In order to invest, investors—especially in the early seed rounds—need to be convinced that you will actually use the money to the business’ advantage. They need to identify how their money will create value for them and the company. How will you create value for investors? – Investing in a business is a risky proposition, even if the financial underpinnings are there. For many, it is much safer to invest in the stock market for an average return of 10%. Therefore, it becomes vital to convince investors that the risk profile is far smaller than the reward potential. In other words, you need to draft a roadmap that details realistic expected ROI in both the immediate and distant future. Who is your perfect partner? – At different stages of a business’ growth, there are several different profiles of investment partners, including:

- Family and friends

- Angel investors

- Banks

- Venture capitalists

- Private equity firms

When it comes time to gather investment, it is not merely about a “cash exchange.” Rather, you need to carefully consider what strategic value that person or group can bring outside of the capital itself. Ideally, you want a partner who can champion the business by leveraging their network to influence growth.

What Is Your Priority—Wealth Creation or Business Control?

Capital raises are never free. In exchange for investment, you will almost always have to give up some form of equity. This can become a fickle balance, because the more money you raise and the more investment rounds you undergo, the more equity is exchanged. This, of course, can lessen your foothold on the business. If your goal is wealth creation, then external investments are often a strategic and necessary way to increase speed to market, maximize customer reach, and grow your brand. But if you want to control and run the business for the long term, then aligning with strategic investors might work against that initiative. In which case, when you choose to seek investment shares a strong relationship with the priorities of the business.

Are There Alternative Options?

Before you give up equity and control, it is wise to at least consider alternative funding solutions. Especially if you are in the early stages of business development and seeking an initial investment, other methods may be more palpable. These include but are not limited to: Business line of credit – This functions similarly to a credit card. You do not receive a lump sum. Instead, you can tap into the line of credit whenever you require the funds. The benefit of this option is that interest rates are closer to a bank loan than a credit card. Traditional bank loans – Traditional loans come with fixed interest rates and monthly payments, and could be used as a short-term liquidity fix. However, the term can be lengthy and leave your business with a significant debt to repay. Crowdfunding – For companies that produce tangible products, individuals have increasingly been willing to fund projects they believe in. For instance, in 2013, Peloton—the at-home exercise bike that delivers live and on-demand indoor cycling classes—raised $307,332 in a crowd-funding campaign on Kickstarter. Today, the company has a market value of $15.4 billion.

Is Your Business Profitable?

One of the most important questions investors want to know is whether the business is profitable? If you are not, that is certainly not the end of the road. Many companies do not make any revenue, let alone profit, for years. However, profitability could signal one of two things: You are ready and ideally positioned to take on investment to rapidly increase growth and profits. You have enough leeway to be patient. Whether or not you decide to take on investment might depend heavily on your runway. How much do you have in the bank that can be used to keep the company afloat should an unforeseen incident pop up? Similarly, how self-sustainable are you? Acquiring external investment can be a long and drawn-out process. It is important that your business can survive the months, if not years, it might take to close a deal. If not, you may need to turn to the alternative funding discussed earlier.

CFO Hub—Professionals Who Can Help You Fundraise

Knowing when to seek investment depends on your company’s financial circumstances, existing infrastructure, and end goals. But, even with all that information, you may not know whether now is the right time. Sometimes, you need an outside perspective to tell you when and how to seek investors. Enter CFO Hub. With us on your team, you can gain access to qualified, outsourced CFOs who act as a strategic fundraising consultant. Together, we can examine your business holistically and determine whether not seeking investment is a viable path forward. Curious how hiring an outsourced CFO could work? Contact us today for your free consultation.

Jack Perkins, CPA founded CFO Hub to provide strategic finance and accounting services to enterprises of all sizes. Prior to founding CFO Hub, Jack served as the CFO and Controller of rapidly growing enterprises in California. Jack's written content has been featured in Forbes, Entrepreneur, and several other notable publications.

Visit Jack's Expert Hub to learn more about his experience and read more of his editorial content